Introduction

According to a McKinsey study, only 37% of change initiatives are fully successful. This statistic highlights the critical importance of effective change management in achieving organizational transformations, particularly in Tunisia’s banking sector. With the rapid evolution of technology and growing customer expectations, change management has become indispensable for banks striving to remain competitive and meet new market demands.

This article delves into how banking institutions can successfully navigate digital transformation by leveraging structured change management, proven frameworks, and success factors tailored to the unique dynamics of this sector.

Understanding Change Management

Change management refers to the set of methods, strategies, and practices implemented to guide companies through transformation processes. In an environment where organizations must continuously adapt to market shifts, technological advancements, and increasing customer expectations, change management becomes a fundamental concept—particularly for banks in Tunisia.

By prioritizing effective change management, financial institutions can not only navigate challenges but also position themselves for long-term growth in a competitive and dynamic industry

Change management in the banking sector must address several critical dimensions to ensure successful transformation:

- Human Factors and Corporate Culture

Digital transformation requires buy-in from employees at all levels, from customer advisors to senior management. Overcoming natural resistance to change involves fostering a culture of innovation and transparency, creating an environment conducive to growth and adaptation. Empowering staff through training and open communication is essential to building trust and engagement.

- Compliance and Security

The digitization of banking operations necessitates stringent measures to ensure compliance with regulations and the protection of customer data. Innovations must align with existing security and confidentiality standards to safeguard the trust of clients and regulators alike. Robust risk management strategies and regular audits are key to maintaining compliance throughout the transformation journey.

- Optimizing the Customer Experience

In an era where customers demand instant and personalized banking services, change management is critical for modernizing customer relationship management tools, automating processes, and enhancing user satisfaction. Digital transformation allows banks to reimagine the entire customer experience, enabling faster service delivery, tailored solutions, and seamless interactions across channels.

Models to Guide Change Management

Various models serve as valuable frameworks to structure change management within an organization. These models provide methodological approaches that help understand and manage the dynamics of transformation effectively.

Kotter’s 8-Step Change Model

Kotter’s model, consisting of eight steps, emphasizes the importance of creating a sense of urgency and involving key stakeholders throughout the process:

- Create a Sense of Urgency: Mobilize teams by making them understand the necessity of change.

- Form a Powerful Coalition: Gather a group of influencers to lead the transformation.

- Develop a Vision and Strategy: Establish a clear direction to guide the change.

- Communicate the Vision for Change: Widely communicate the vision to gain employee buy-in.

- Empower Action Across the Organization: Remove obstacles and enable everyone to take action.

- Generate Short-Term Wins: Create quick wins to reinforce engagement.

- Consolidate Gains and Drive More Change: Use successes to encourage further initiatives.

- Anchor New Approaches in the Culture: Integrate changes into the organization’s values and practices

The ADKAR Model

The ADKAR model emphasizes five essential elements required for the successful adoption of change:

- Awareness: Inform employees about the need for change.

- Desire: Spark the willingness to participate in the change.

- Knowledge: Provide the necessary information for implementation.

- Ability: Develop the skills required to apply the change.

- Reinforcement: Maintain the changes through ongoing support.

Lewin’s Change Model

Composed of three stages, this model offers a simplified approach to managing change:

- Unfreeze :Prepare individuals for change by addressing resistance and creating a favorable environment.

- Change : Implement the new practices and processes

- Refreeze : Consolidate the changes to make them the norm within the organization

Digital Transformation: A Critical Challenge for Banks

With increasingly connected customers, banks must offer secure, fast, and personalized digital services. Digital transformation becomes a strategic asset, allowing banks to maintain their competitiveness by modernizing customer interactions, optimizing operational efficiency, and enhancing the overall customer experience.

Keys to Success for Change Management

- Effective Communication: Open and transparent communication fosters team engagement. Regularly informing employees about the goals, stages, and outcomes of the change is essential to keep their motivation high.

- Inspirational Leadership: Leaders must play a key role in the change process. Their commitment and support are crucial to gaining buy-in and mobilizing teams.

- Training and Support: Offering tailored training and personalized support helps employees develop the skills necessary to adapt to new practices.

- Culture of Innovation: Encouraging a company culture that is open to experimentation and continuous learning helps overcome resistance and promotes the adoption of new practices.

Operational Management of Change Management

Managing change in the banking sector relies on rigorous operational planning and targeted actions to ensure the effectiveness of the process. Here are the key steps to follow:

- Establish Precise Monitoring Indicators:It is essential to implement a dashboard to measure the impact of transformations on operational efficiency. This dashboard should include performance indicators, adoption rates of new practices, and user feedback to track the progress of change and identify areas for improvement.

- Encourage Engagement of Key Stakeholders : Organizing workshops and practical training strengthens employees’ adoption of new practices. Engaging key stakeholders is crucial for ensuring a smooth transition and maximizing the positive impact of changes on operational efficiency.

- Structured Deployment of Actions: Developing a transition plan in collaboration with team leaders helps guide employees during the transformation phase. This structured deployment ensures that new initiatives are effectively integrated into daily operations, thereby contributing to improving the overall performance of the organization.

How to Measure Change Management: Key KPIs to Track

To measure the effectiveness of change management initiatives, it is essential to define relevant Key Performance Indicators (KPIs). Here are some crucial KPIs to consider:

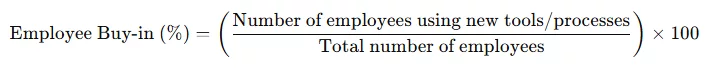

- Employee Buy-in: This indicator measures the adoption rate of new practices within the organization, calculated as the percentage of employees using the newly implemented tools and processes.

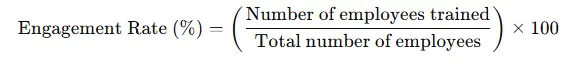

- Stakeholder Engagement: Engagement is measured by the training participation rate, which represents the proportion of employees trained compared to the total number of employees.

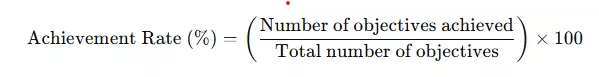

- Impact on Performance: The impact of change management on performance is measured by the achievement rate of objectives, which indicates the percentage of objectives that have been met.

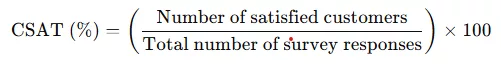

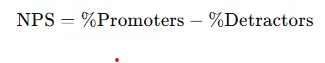

- Customer Satisfaction: This KPI includes the Customer Satisfaction Score (CSAT), which measures the percentage of satisfied customers, and the Net Promoter Score (NPS), which evaluates the likelihood of customers recommending the company.

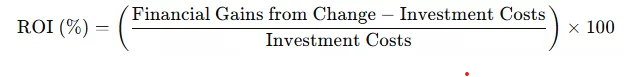

- Return on Investment (ROI): Finally, ROI must be calculated to assess the economic effectiveness of change initiatives. It helps determine whether the investments made for digital transformation have generated positive financial returns.

Change Management with Liberrex in the Banking Sector

Liberrex positions itself as a strategic partner in change management regarding customer experience. Through its automation and digitalization solutions, Liberrex helps banks simplify operations management, enhance customer experience, and increase operational efficiency.

Over the past two years, Liberrex has supported major financial institutions in Tunisia, including BIAT Bank, BTK Bank, and GAT Assurances, in their digital transformation journey. Despite the unique characteristics of each organization, Liberrex has successfully tailored its solutions to meet the specific needs of each one. With its expertise, it has facilitated a transition to smoother, more innovative, and customized customer and employee experiences. This partnership has thus optimized operational efficiency and increased satisfaction within these institutions.

By supporting each company in its digital transformation of customer experience, Liberrex ensures continuous monitoring and adjusts solutions based on results, enabling banks and financial institutions to remain competitive and meet the evolving expectations of their clients.

Conclusion

Change management is a critical strategic challenge for the successful digital transformation of banks in Tunisia. By implementing proven models and adopting a human-centered approach, financial institutions can enhance their customer experience, strengthen their competitiveness, and build a promising future. Ultimately, the key lies in the sincere commitment of teams to embrace change and innovate to meet the challenges of an ever-evolving environment.