In a rapidly evolving landscape of customer expectations, banks in Tunisia must embrace innovative solutions to provide a seamless and customer-centric experience. Among these solutions, the online Booking management system stands out as a key tool for transforming interactions between banks and their clients.

According to a Deloitte study, 72% of surveyed customers prefer digital channels for their banking interactions, highlighting the critical role of digitalization in the banking sector. This shift presents an opportunity for banks to redefine their customer journey.

Why Adopt an Booking Management System in the Banking Sector?

the Booking management systems offer strategic advantages for both customers and internal banking teams.

Simplified Customer Journey

Customers benefit from a smooth and quick experience by scheduling Booking online. By removing complex steps such as making phone calls or waiting for manual confirmations, the system streamlines the process, enhancing satisfaction. According to a Forrester study, the majority of consumers prefer to interact with their bank via digital tools, making this solution highly relevant in today’s context.

Improvement of Internal Organization

Optimizing schedules is another major advantage. By allowing banking teams to see scheduled appointments in real-time and gain visibility on requests, they can better anticipate customer needs and prepare more effectively. This not only improves internal efficiency but also enhances the quality of customer interactions. A study has shown that banks that have implemented an online Booking management system experience a significant increase in customer satisfaction, reaching up to 40% in some cases.

What are the Benefits of Online Appointment Booking?

For Customers:

- Increased Accessibility: The online Booking management system allows customers to schedule appointments anytime, from a smartphone, tablet, or computer, without being limited by branch opening hours.

- Personalization: Customers can choose the service or advisor best suited to their specific needs, enhancing their experience. This personalization increases satisfaction and strengthens their relationship with the bank.

- Reduced Waiting Times: Through automated Booking management, banks can better organize customer flows, reducing physical queues and waiting times.

For Banks:

- Improved Operational Efficiency: The online Booking management system helps better organize advisors’ schedules, eliminating downtime and maximizing time dedicated to higher-value tasks, such as personalized customer support.

- Customer Loyalty: A smooth and personalized customer experience via an online appointment system strengthens customer trust and fosters loyalty. Satisfied customers are more likely to recommend their bank and remain long-term clients.

- Reduced Congestion: By optimizing appointment management, banks can avoid unexpected waiting periods, maximizing time slot utilization and improving time management.

How Does an Online Booking System Work?

Step 1: Access the Booking Platform

The customer journey begins with convenient access to the bank’s dedicated online appointment booking platform. Customers can easily log in through the bank’s official appointment website, ensuring a secure and user-friendly experience. Whether accessing via a desktop, tablet, or mobile device, the platform is designed for optimal responsiveness and ease of navigation.

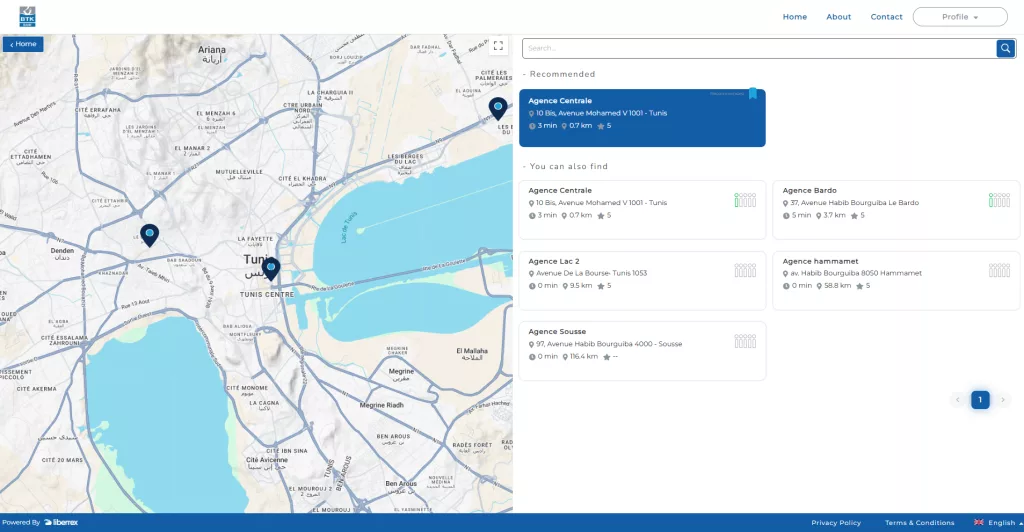

Step 2: Choose the Nearest Branch

Once logged into the appointment booking platform, customers are guided to select the branch or banking service that best meets their needs and geographical preferences.

The platform displays a comprehensive list or interactive map of available branches, complete with key details such as location, opening hours, and available services. Customers can easily filter options based on proximity, specific banking services offered, or branch availability.

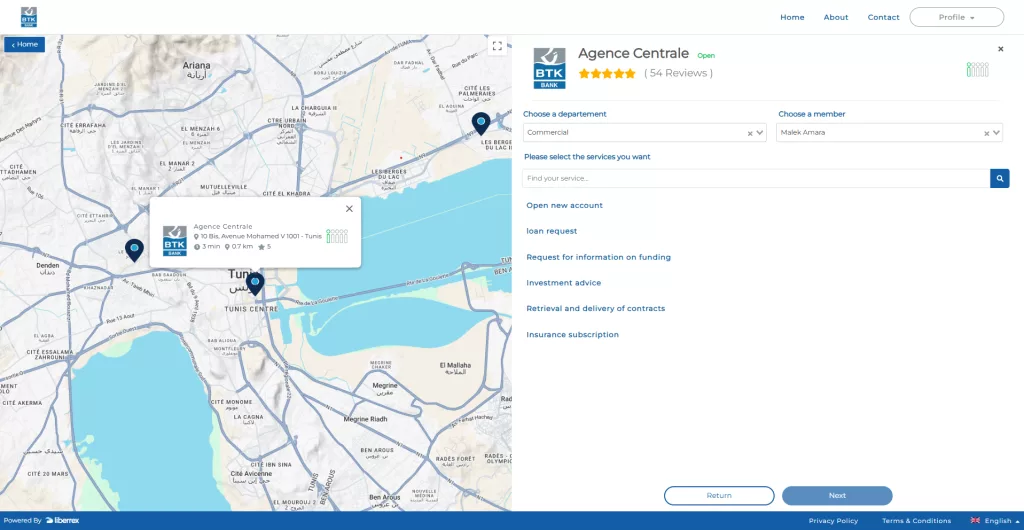

Step 3: Choose the Desired Service

After choosing their preferred branch, customers proceed to select the specific banking service that aligns with their needs. The platform offers a clear and categorized list of available services

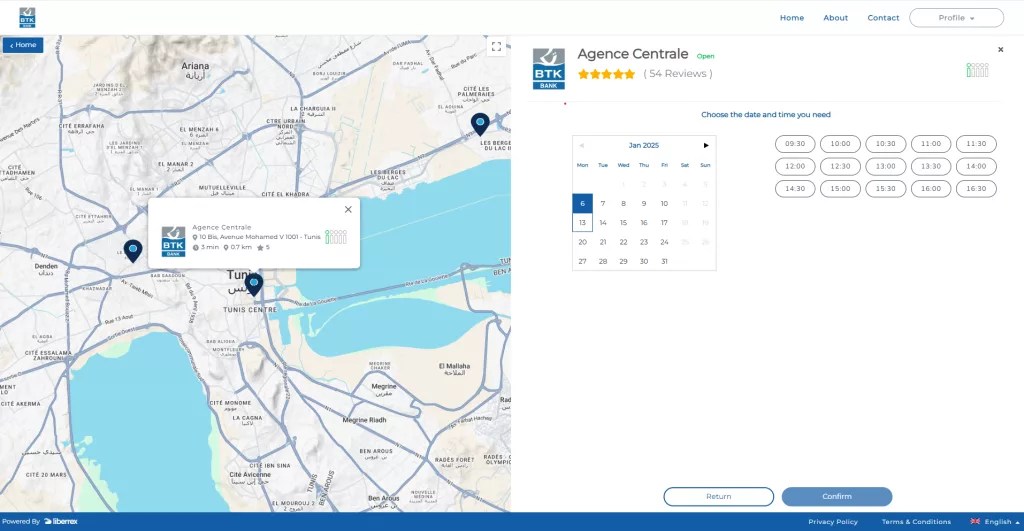

Step 4: Choose a Suitable Date and Time

Customers can pick a date and time that best suits them from the available slots. On the other side, advisors have a dedicated space to organize their schedule efficiently, with real-time visibility of booked and available slots.

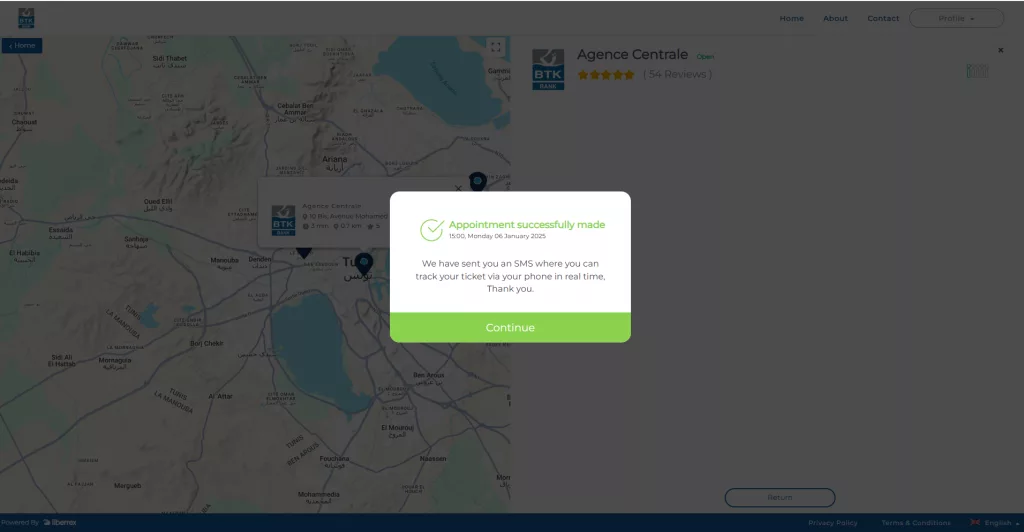

Step 5: Appointment Confirmation

Once the appointment details are finalized, the customer receives an instant confirmation via SMS, ensuring clarity and convenience

How Does Online Booking Impact Customer Satisfaction in Tunisian Banks?

The online Booking management system is essential for improving the customer experience and optimizing internal organization in banks. In Tunisia, where the digitization of banking services is rapidly advancing, adopting these solutions enables banks to remain competitive while meeting the expectations of increasingly connected customers.

In an increasingly competitive banking sector, adopting this system goes beyond technical improvements. It represents a strategic response to new consumer expectations, especially regarding time management. By enabling customers to manage their appointments online, banks value their customers’ time, offering them greater flexibility and autonomy in their processes.

In Tunisia, where endless queues and time wasted during frequent trips are daily realities in almost all institutions, this system becomes a true transformation lever. It provides customers with a smoother and more enjoyable experience, reducing the negative impact of waiting times and contributing to their overall loyalty and satisfaction.

Banks that invest in this system position themselves as leaders in digital transformation and strengthen their relationship with customers, offering a modern, optimized experience that respects everyone’s time

Conclusion

Digital solutions like online appointment management systems enable banks in Tunisia to improve customer experience and optimize internal operations. By adopting this technology, banks ensure their competitiveness while delivering a personalized and efficient customer experience. This modern approach is essential for banks aiming to meet consumer needs and strengthen their market presence.